The Cabinet of Ministers issued a resolution on June 4 (No. 352) waiving a list of process equipment not produced in the country from customs duties and value added tax (VAT) when imported into the territory of Uzbekistan, the Ministry of Justice said.

According to the resolution, the waivers on payment of import duties and VAT shall be applied to new process equipment with special codes (HS Code) included in this list.

New process equipment is the equipment that was produced no more than 3 years ago at the time of customs clearance under the “release for free circulation” customs regime.

The list includes 676 types of process equipment, in particular:

- nuclear reactors;

- equipment and devices for isotope separation;

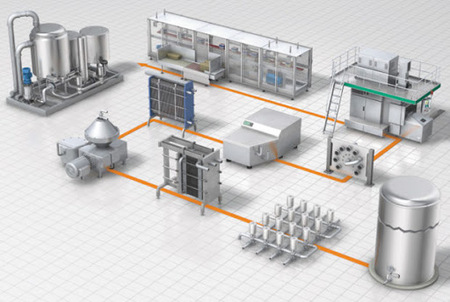

- equipment for processing milk;

- equipment for the production of bakery products, pasta, spaghetti or similar products;

- equipment for the confectionery industry, the production of cocoa powder or chocolate;

- equipment for processing meat or poultry;

- yarn dyeing machines;

- automatic sewing machines;

- civil passenger aircraft with more than 50 passenger seats, but less than 300 people;

- some types of medical equipment and others.